Blogs

What Expenses Can I Claim for Working From Home as Self-Employed?

Reasonable Method

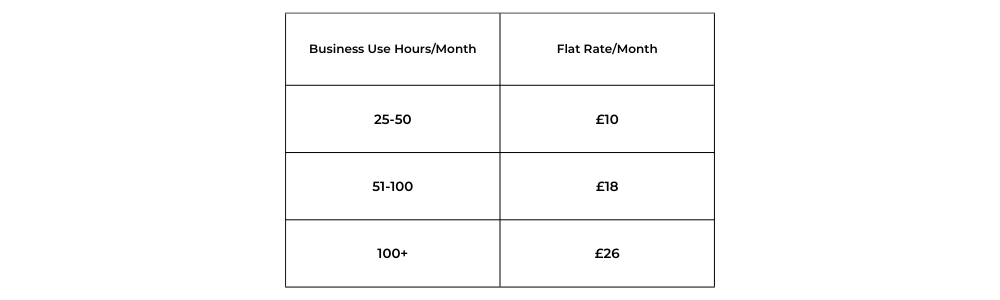

If you do not qualify for the Simplified Method (because you work for less than 25 hours a month from home, or you simply don't want to use this method), you have the option of the Reasonable Method. This method requires you to claim a proportion of your work-related expenses based on your total expenses. Specifically, you would divide your total household costs by the number of rooms used only for working from home, and/or the time you spend working from home. This can be done in three steps:

- Working hours eg the type of work you do, other work locations, other employers who also work at your home

- How many hours is your home used for business each day?

- Working rooms

- How many rooms are in your house?

- How many rooms in your house do you only use for your business?

- How many rooms in your house are used for both business and private use?

- Work out the total costs you can claim

- Add up the total costs

- Divide the total costs by the number of rooms in your house

- Half the number of rooms in your house used for both business and private use, then add this to the number of rooms used only for business use

- Add the number you calculated in b) and the number you calculated in c) to get the total number of expenses

Example: If you have 3 rooms in your home, you use one exclusively as an office and your electricity bill for the year is £300. If every room in your home uses equal amounts of electricity, you can claim £100 (£300 divided by 3) as expenses. If you worked only two days a week from home, and you use that room all 7 days of the week, you could claim £28.57 as allowable expenses (£100 divided by 7, multiplied by 2). Please get in touch with us if would like a free template for home office use calculations.

What Home Expenses Can I Claim?

There is a wide range of fixed expenses you can claim a proportion of if you're self-employed, work from home and use the Reasonable Method, including:

- Council tax

- Rent/mortgage interest

- Broadband/internet/phone usage

- Water

- Insurance

There are also variable expenses which will vary across each payment time:

- Heating/gas

- Electricity

- Repairs/maintenance

- Cleaning

If you work from home and are self-employed, make sure you correctly work out the tax expenses you can claim, using the methods specific to working from home and being self-employed - there are other ways of calculating your tax relief if you work from home for a limited company, for an employer etc, and you cannot claim work from home expenses if your employment contract lets you work from home some or all of the time, you work from home because of COVID-19, or your employer has an office, but you cannot always work there sometimes because it’s full.

If you work from home running your own small business as a sole trader, and you require any further assistance and you require further assistance on claiming your ‘use home as office’ allowance, do not hesitate to get in contact with us for a free 30-minute consultation by calling us at 07762657277.