Blogs

What Are Some Examples of Capital and Revenue Expenditure?

There are normally two forms of

capital expenditures:

acquisition

expenditures - expenses to

maintain

levels of operation present within the company, and

expansion

expenditures - expenses that will enable an

increase

in future growth. A capital expense can either be tangible (eg a machine) or intangible (eg a patent) - both can be considered assets as they can be sold when there is a need.

- Buildings and Property: Purchases of property, plant and equipment are often facilitated using secured debt or a mortgage, whereby the payments are made over many years. Make sure you know what is considered a repair (not extending the useful life of the asset) and a capital upgrade;

- Upgrades to Equipment: if these upgrades are higher than the capitalisation limit that is in place, the costs should be depreciated over time. Equipment upgrades are often financed and the cost of this may be depreciated also;

- Software Upgrades: these are a significant cost for large companies and can be depreciated if they meet specific criteria. Internal research and development expenses related to creating new software must be capitalised and depreciated over the life of the asset (including fees paid to external parties that assisted with the software development, costs for long-term software, payroll for employees that worked on the development, travel in connection with the development);

- Computer Equipment: this includes servers, laptops, desktop computers, and peripherals, and must have a useful life of greater than one year. A company may set an internal materiality threshold to avoid capitalising every calculator purchased and held for greater than a year;

- Vehicles - companies often need a fleet of vehicles for distribution or to carry out services for customers, such as delivery companies. These vehicles are considered capital expenditures, regardless of whether they were purchased outright or financed with debt. However, the costs for leasing vehicles are treated as operational expenses; and

- Intangible Assets - assets don't all need to be physical or tangible. If a company purchased a patent or a license, it could be considered a capital expenditure.

Revenue expenditures can be split into direct and indirect expenses.

Direct

expenses occur from the production of raw materials to final goods and services. The direct expense example is wages of labour, shipping cost, power, electricity bill cost, rent, commission, legal expense, etc.

Indirect

expense occurs indirectly; they are generated in connection with selling goods and services and their distribution. Indirect expense examples are machinery, depreciation, wages, etc.

- Repair and Maintenance of the Assets: incurred for supporting the business’s current operations and do not affect the asset’s life;

- Wages paid to workers of the Factory: required to work for the company and run the business to generate revenues;

- Utility Expenses: expenses incurred on phone bills, water bills, electricity bills, etc., are required to be spent by the company to continue its business operation and generate revenue - the working of the businesses cannot effectively take place without these resources;

- Selling Expenses: required for selling the products timely (used to promote and market the products to the customers) thus increasing the business sales;

- Rent Expense: expenses incurred in renting the premises the business operates on and/or renting the other materials; and

- Other Expenses: any other expenses related to generating the revenue of the business or maintenance of revenue-generating assets.

How Do I Deal With Gains From Different Types of Capital Assets?

For businesses, a capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business's operation. It is important to know what to do should you experience gain or loss with your business’ capital assets.

A capital gain is an increase in the value of a capital asset when it is sold. It occurs when you sell an asset for more than what you originally paid for it. Capital gains are either short-term - realised on assets that you've sold after holding them for one year or less, or long-term - realised on assets that you've sold after holding them for more than one year.

You may have to pay Capital Gains Tax if you make a profit (gain) when you sell (or dispose of) all or part of a business asset, such as

- Land and buildings;

- Fixtures and fittings;

- Plant and machinery, eg a digger;

- Shares;

- Registered trademarks;

- Your business’s Goodwill.

A gain is a difference between what you paid for your business asset and what you sold it for. Use the market value instead if you:

- Gave it away (different rules apply if it was to your spouse, civil partner or a charity);

- Sold it for less than it was worth to help the buyer;

- Inherited the asset (and do not know the Inheritance Tax value); and

- Owned it before April 1982.

If the asset was given to you and you claimed Gift Hold-Over Relief, use the amount it was originally bought for to work out your gain. If you paid less than it was worth, use the amount you paid for it.

You can deduct certain costs of buying, selling or improving your asset from your gain, including

- Fees, eg for valuing or advertising assets;

- Costs to improve assets (but not normal repairs); and

- Stamp Duty Land Tax and VAT (unless you can reclaim the VAT).

There are, however, certain costs you cannot deduct, including

- Interest on a loan to buy your asset; and

- Costs you can claim as business expenses

When you know your gain you need to work out if you need to report and pay Capital Gains Tax. If you’re in a business partnership, work out your share of each gain or loss; then the nominated partner must fill in form SA803.

if you’re eligible for tax relief, you may be able to reduce or delay the amount of Capital Gains Tax you have to pay:

How Do I Deal With Losses From Different Types of Capital Assets?

A capital loss occurs when a capital asset, such as an investment or real estate, decreases in value. This loss is not realised until the asset is sold for a price that is lower than the original purchase price. Such losses are subtracted from any chargeable gains which the company has for the same accounting period. The remainder is carried forward for set-off against gains of future periods. In some circumstances, however, relief for losses may be restricted or denied under anti-avoidance legislation.

A loss on a disposal to a connected person is deductible only from chargeable gains arising on disposals to that same person while they are still connected - known as ‘clogged losses’. As of April 2020, relief for carried-forward losses may be restricted in a similar way to income losses. An annual £5 million deductions allowance must be shared between income and capital losses in a ratio chosen by the company. The purpose of capital loss restriction is to limit the number of chargeable gains that can be set off against carried-forward losses to 50% - specifically, where the losses surpass the amount of the deductions allowance that is allocated to chargeable gains.

If you have a capital asset that is lost or destroyed, this must be treated as a disposal. If you receive compensation, the amount of compensation you receive is treated as the sales proceeds. If shares you own lose all or most of their value, due to the company involved either stopping trading or going into liquidation or receivership, you might be able to make a ‘negligible value claim’.

When you make a negligible value claim, if all the conditions are met, they are treated as if you sold the shares and then bought them back again at their value (creating a loss) on the earliest of the following dates:

- The date that HMRC receives the claim; and

- A date you specify on the claim that may be

- in either of the two previous tax years if the shares became worthless/ almost worthless at that time or

- earlier, allowing you to treat the loss as arising in a different tax year – this may be important if you have large gains in one of the two years as it could help you minimise any capital gains tax bill.

You then work out your capital loss as if you sold the shares for their negligible value on that date.

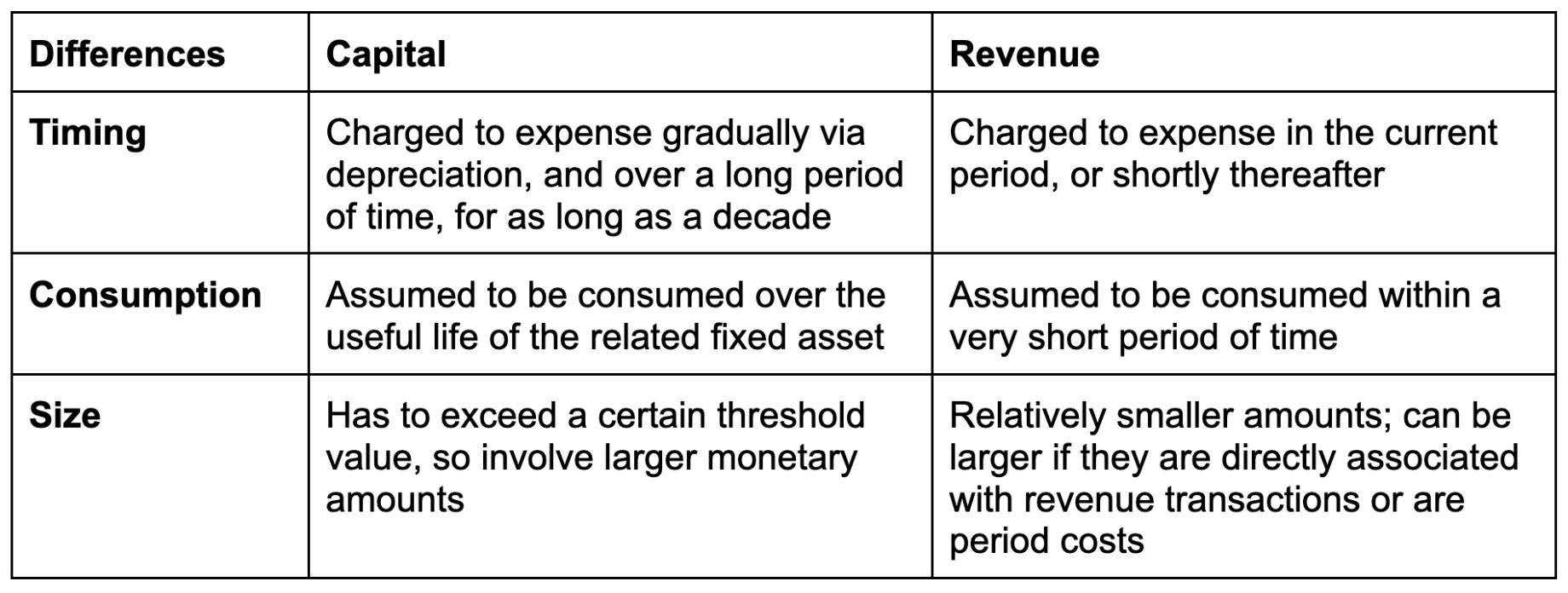

In conclusion, it's crucial to know the difference between capital expenditure and revenue expenditure. Understanding each type of expenditure will enable you to classify them correctly in the accounts. Also, each type of expenditure will determine the tax you pay - depending on whether you write them off or capitalise them - and if you can claim for business expenses, as well as super deductions which are available only until 31 March 2023.

If you need further clarity in regards to your business capital and revenue expenses, as well as what to do if your capital assets have gains or losses, do not hesitate to contact us here at Kubed Solutions for a free 30-minute consultation by calling 07762657277.