Blogs

- 45p per mile if you've travelled less than 10,000 business miles per tax year, and

- 25p per mile business miles over 10,000.

You may be offered the most tax relief from choosing to buy a pool car. However, depending on the car's needs, it may not be the right option for your business due to the stringent requirements of what a pool car is. You may, as a director, opt for buying a company car through your limited company. If you do, you can only reclaim VAT on business-related expenses eg MOT and service, car insurance etc.

Moreover, a company car used for personal and business purposes will incur Benefit in Kind (BiK) tax (up to 37% for petrol and diesel cars depending on their emissions) - for which the company will be required to fill in a P11D and P11D(b) form. Benefit in Kind is seen as a perk from the company, and so the receiver of this perk (aka the individual who uses this company car) will have to pay tax on the value of the perk at their personal income tax rates (between 20-45% depending on their income band). Limited company directors will additionally have to pay 13.8% National Insurance on the benefit value.

Be aware that it may not be worth buying a company car should the BiK increases your income to the point where you join the next income tax band.

Leasing a Non-Electric Car for Business

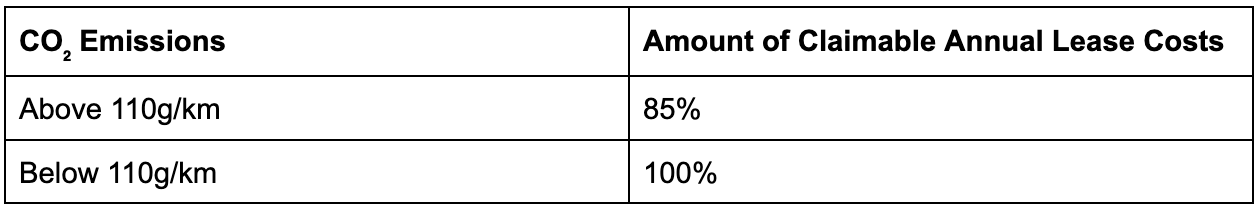

Some business owners in need of a car may choose to go down the leasing route, whereby the company rents a car for a monthly payment for a specific time period. You may find it more cost-effective to lease a pool car rather than buy it. You won't be able to claim capital expenses because the asset (car) is not owned by you. However, the lease payments count as a business expense that you'll be able to claim. The amount which your limited company can claim against the company’s corporation tax bill is dependent on an allowance based on the CO₂ emissions of the car.

Furthermore, you will also be able to reclaim the VAT on lease payments, so long as the users adhere to the requirements the car as a pool car (no personal use, used by more than one employee).

With regards to leasing a company car rather than a pool car, car leasing companies are known to provide a cheaper deal for business cars compared to personal car leases. Also, you will normally be able to recover 50% of the VAT charged; the 50% block on VAT recovery is to cover the private use of the car.

While this may seem like a benefit in terms of cost, leasing company cars may well be one of the least cost-effective methods of using a car for your business. You cannot claim capital allowances - as with leasing a pool car - but additionally, because it still counts as a Benefit in Kind, you'd still be subject to pay personal income tax as well as NI on the value of the vehicle.

Buying or Leasing an Electric Car via Your Business

Following the government’s plans to eliminate the sale of all petrol and diesel cars by 2030 and hybrid cars by 2035, the use of electric cars is on the rise - including for businesses. It is therefore important to know the cost implications of doing so.

100% of your capital allowance can be claimed against your tax bill in the first year of buying and using an electric car. The company may also make further savings on their corporation tax on monthly payments interest, should the car be acquired under a Hire Purchase agreement (whereby the buyer pays an initial instalment followed by instalments of the balance plus interest over time). Leased cars can additionally benefit from a reduction of the company’s profit and corporation tax for the year, as the monthly rentals for the car count as an expense in the profit and loss account.

In terms of VAT, you can reclaim the 20% VAT from buying a car if the car is used exclusively for business purposes (not including commuting), while 50% can be reclaimed from leasing a car. The 130% super deduction (which you can read about in our blog post here) granted by the government for businesses investing in ‘plants and machinery', including electric vehicle charging points, qualifies until March 2023, saving your business further.

Moreover, while electric business cars used also for personal uses are subject to Benefit in Kind tax, just as other types of cars are, it is at a significantly lower BiK rate of 2% of the car’s list price. Tax and national insurance on BiK may be paid by the employee and/or the company:

- Amount employee will pay = list price of the car x 2% (current BIK rate for electric cars) x employee’s income tax rate

- Amount company will pay = list price of the car x 2% (current BIK rate for electric cars) x 13.8% (employers national insurance rate)

For charging points, the installation at an employee’s address, associated with the car, as well as its electricity use for charging it, does not count as a BiK (including businesses using a home office). Drivers of the car can either:

- Pay for the cost of home and/ or public charging the car upfront and then reclaim the costs; or

- Log their private mileage (including commuting to and from work) and have the costs of this personal mileage deducted from the driver’s salary after their employer has paid for all electricity costs.

To conclude, you need to consider many factors before you start implementing the use of a car for your business, such as the type of car, how it will be purchased and how it will be used. Doing so will ensure that the decisions you make are the most tax-efficient.

If you're a business owner and need any more information before you invest in a car for your business, or need help calculating which methods will offer you the most tax relief based on the specific needs of a car for your business, do not hesitate to contact us here at Kubed Solutions for a free 30-minute consultation by calling 07762657277.